Understanding Texas contractor bonding requirements is crucial for anyone in the construction industry. Whether you’re a contractor or a client, knowing the ins and outs of bonding can save you from legal headaches and ensure that projects run smoothly.

In this post, we’ll break down what contractor bonds are, why they’re important in Texas, and how to obtain one. By the end, you’ll have a clear understanding of the bonding process, helping you navigate Texas contractor laws with confidence.

What is a Contractor Bond?

At its core, a contractor bond is a type of surety bond that contractors must have to legally work on certain projects. In Texas, these bonds are essentially a financial guarantee that the contractor will fulfill their obligations according to the contract. If a contractor fails to meet these obligations, the bond provides a safety net for the client, ensuring they are compensated for any losses.

Benefits of Complying with Bonding Requirements

Complying with Texas contractor bonding requirements offers several benefits:

- Client Trust: Bonds increase client confidence, knowing they have financial protection.

- Increased Opportunities: Proper bonding opens the door to larger projects, particularly in the public sector.

- Legal Protection: Bonds provide a layer of legal protection for both contractors and clients.

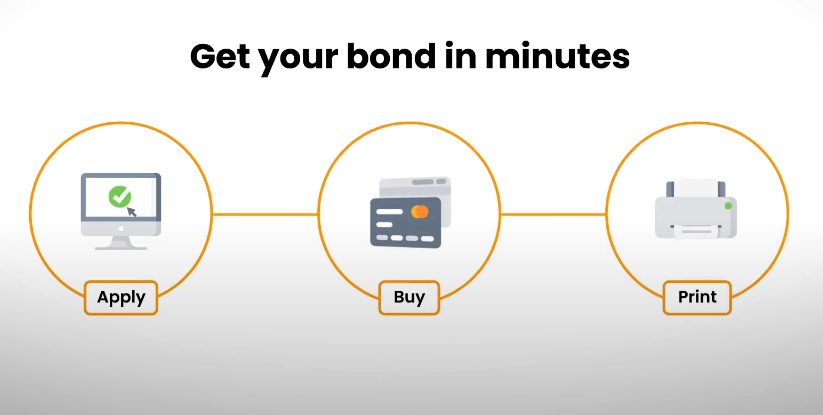

How to Obtain a Contractor Bond in Texas

Securing a contractor bond in Texas is a straightforward process:

- Determine the Required Bond: Identify which type of bond you need for your project.

- Choose a Bond Provider: Work with a reputable surety bond company. They will assess your eligibility based on factors like credit score and business history.

- Submit Your Application: Provide the necessary documentation and information about the project.

- Pay the Premium: The cost of the bond, typically a small percentage of the total bond amount, will be determined by your risk profile.

Types of Contractor Bonds in Texas

In Texas, there are several types of contractor bonds you might encounter:

- Bid Bonds: These bonds guarantee that a contractor will enter into a contract if their bid is accepted.

- Performance Bonds: These ensure that the contractor will complete the project as agreed.

- Payment Bonds: These protect subcontractors and suppliers, ensuring they get paid even if the contractor defaults.

Each type of bond serves a specific purpose, and depending on the project, you might need one or more of these bonds.

Why Contractor Bonding Requirements Are Important in Texas

Texas contractor bonding requirements are designed to protect both contractors and their clients. For contractors, having the appropriate bonds can enhance credibility and make it easier to win bids on projects. For clients, bonds provide assurance that the project will be completed as agreed, and they have financial recourse if it isn’t.

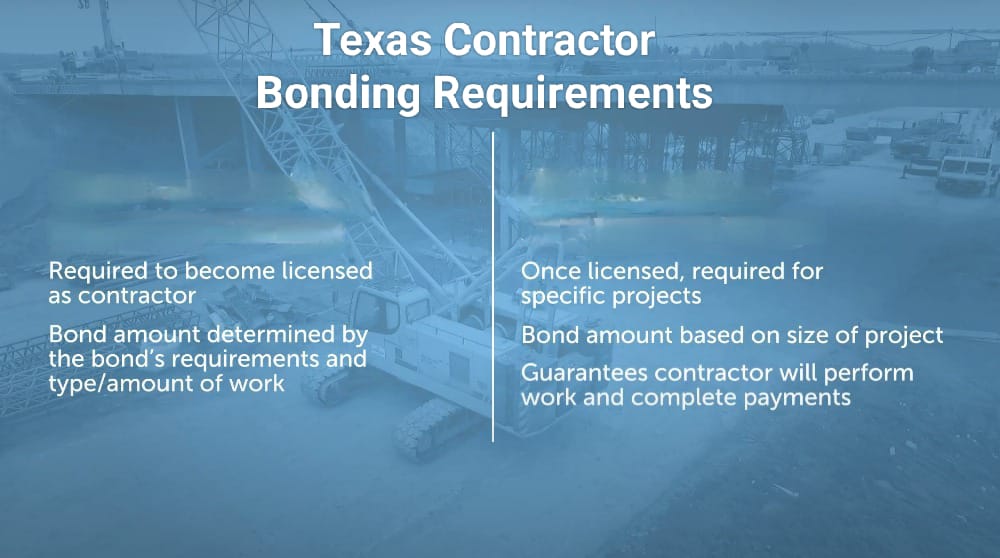

Texas Contractor Bonding Requirements Laws

Texas law mandates that certain contractors obtain bonds before they can legally work on specific types of projects. Generally, any contractor working on public projects or large-scale private projects will need to secure a bond. Here’s a breakdown of the key points:

- Public Projects: Texas requires that contractors working on public projects (e.g., government buildings, infrastructure) have a bond in place.

- Private Projects: For private projects, a bond might be required depending on the contract’s terms or the project’s value.

Failure to obtain the required bonds can result in legal penalties, including fines or the loss of your contractor license.

Costs and Factors Affecting Bonding

The cost of a contractor bond in Texas varies based on several factors:

- Credit Score: A higher credit score usually means a lower bond premium.

- Project Size: Larger projects typically require higher bond amounts, which can increase the premium.

- Business History: A strong track record of completed projects can lower your bond costs.

Legal Consequences of Not Having a Texas Contractor Bonding Requirements

If you fail to meet the Texas contractor bonding requirements, the consequences can be severe:

- Fines: You could face significant fines for operating without the necessary bonds.

- Legal Action: Clients may take legal action against you, resulting in costly litigation.

- License Revocation: In some cases, you could lose your contractor license, effectively ending your ability to work in Texas.

Stay Updated on Texas Contractor Bonding Requirements Regulations

Texas contractor bonding requirements can change, so it’s essential to stay informed about any updates in the law. Regularly check the Texas Department of Licensing and Regulation (TDLR) website for the latest information. Consulting with a legal expert or bond agent can also help ensure you’re always compliant.

Conclusion

Understanding and adhering to Texas contractor bonding requirements is vital for the success and legality of your construction projects. In addition, By securing the right bonds, you protect yourself, your clients, and your business reputation. Always make sure you have the appropriate bonds in place before starting any project, and stay informed about any changes in Texas bonding laws.

For more information or personalized advice, consider reaching out to a professional bond agent or legal expert. Remember, proper bonding isn’t just a legal requirement—it’s a smart business decision.

FAQs

-

What are Texas contractor bonding requirements?

Contractors in Texas must secure bonds, especially for public projects, to guarantee project completion and payment to subcontractors.

-

How much does a Texas contractor bond cost?

The cost varies based on your credit score, business history, and project size. Typically, it’s a small percentage of the bond amount.

-

Can I get a Texas contractor bond with bad credit?

Yes, but expect higher premiums. Some providers specialize in bonds for those with bad credit.

-

What happens if I don’t meet Texas contractor bonding requirements?

You risk fines, legal action, and losing your contractor license if you don’t have the required bonds.

-

How do I apply for a Texas contractor bond?

Choose a bond provider, submit your application with required documents, and pay the premium based on your risk profile.